Home » Farm Insurance » Tractor Protect

Tractor Insurance in Ontario

When adding onto your home policy just won’t cut it, we’ve got an enhanced program dedicated to the niche coverage you’re looking for. Buy your policy online in minutes, with Tractor Protect.

A One-Of-a-Kind Program Built Specifically For You

When it comes to protecting your valuable assets, having the right tractor insurance is essential. As a farmer or a business owner operating in Ontario, you understand the significant investment that a tractor represents. Whether it’s for your agricultural operations, landscaping business, or other commercial uses, a comprehensive insurance policy is crucial to safeguard against potential risks.

At Duliban Insurance Brokers, we recognize that no two farmers or businesses are the same, which is why we offer a one-of-a-kind program built specifically for you.

why protect

Where can you get coverage?

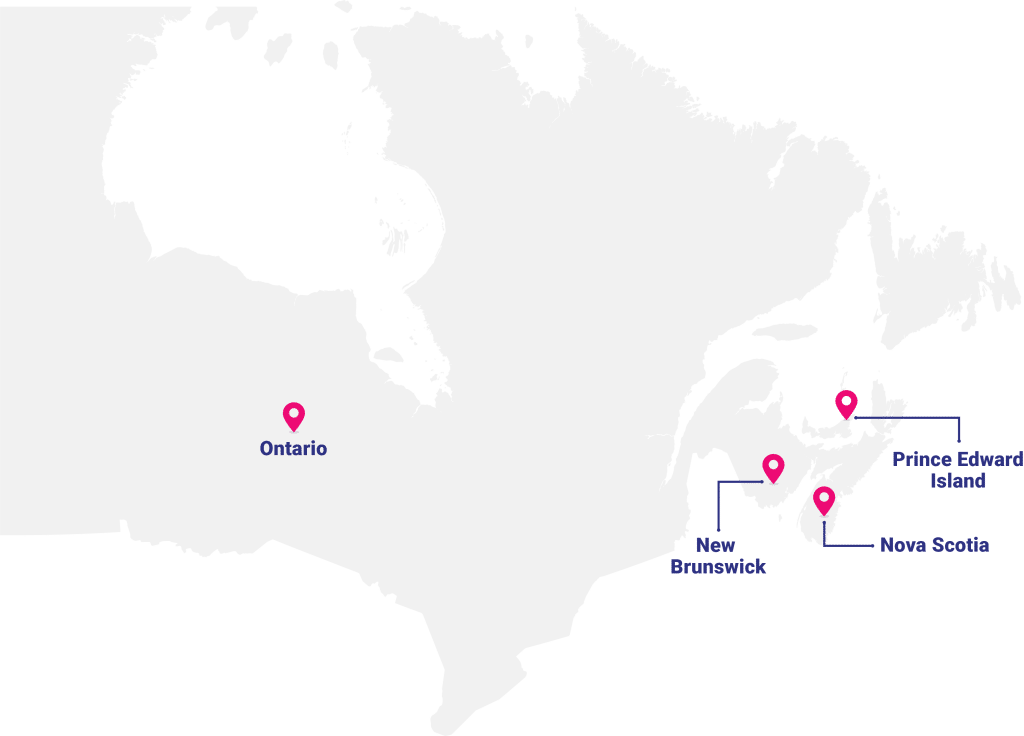

We provide coverage in Ontario, New Brunswick, Nova Scotia, and Prince Edward Island.

qualifications

Does your tractor qualify?

In order to be eligible for this program, your tractor must not be used to generate a profit or for farming operations.

why protect

Why protect your tractor with its own policy?

Rather than add your tractor to an existing home policy, Tractor Protect provides extended coverage beyond your premises. For example, if you were to assist a nearby neighbour or clear the snow at the end of your driveway, a tractor on your home policy would cease to protect you from liability in the event of an accident.

We found this to be a major gap in the existing industry, and sought to provide extendable coverage that protects off-property activities without requiring an independent farm policy.

Tractor Protect includes additional features with the Platinum Endorsement Package. With this fee increase, you would benefit from:

- Decreased deductible to $250 from $500

- $25,000 extension of coverage for tractor accessories

- $2,500 coverage for a rental tractor

Want to know how much your tractor will cost?

Why is Tractor Insurance Essential in Ontario?

Tractors play a pivotal role in various agricultural and commercial activities across Ontario. From plowing fields and planting crops to transporting goods, your tractor is indispensable to your day-to-day operations. However, this indispensable equipment is not without risks. Accidents, natural disasters, theft, and mechanical breakdowns can all lead to significant financial losses if your tractor is not adequately insured. This is where tractor insurance in Ontario becomes a vital aspect of your risk management strategy.

Having the right tractor insurance means more than just protecting your vehicle. It ensures that your operations can continue smoothly even in the face of unforeseen circumstances. Whether you use your tractor for personal farming needs or as part of a larger business operation, a tailored insurance policy can provide the peace of mind you need.

Why Choose Duliban Insurance Brokers for Your Tractor Insurance?

At Duliban Insurance Brokers, we understand that a one-size-fits-all solution won’t cut it when it comes to tractor insurance. This is why we have developed a specialized tractor insurance program that is designed to meet the unique needs and preferences of Ontario farmers and business owners.

Here’s what sets Duliban Insurance Brokers apart:

- Customized insurance solutions. Your farming operations are unique, and so are your insurance needs. We believe that you deserve a policy tailored to your specific requirements. Our team of experienced brokers takes the time to understand your operations, the type of tractor you own, and the risks you face. This allows us to create a customized insurance policy that provides comprehensive coverage while also being cost-effective.

- Extensive coverage options. Our tractor insurance in Ontario covers a wide range of risks. From collision and comprehensive coverage to liability insurance and protection against theft, we ensure that every aspect of your tractor is safeguarded. Additionally, we offer optional coverages such as equipment breakdown insurance, which can be crucial in case of unexpected mechanical failures.

- Expert advice and support. Navigating the complexities of tractor insurance can be challenging. That’s why our brokers are here to guide you every step of the way. With our tractor insurance company, you have access to a team of experts who are knowledgeable about the specific challenges faced by farmers and business owners in Ontario. We’re here to answer your questions, explain your options, and help you make informed decisions about your coverage.

- Competitive pricing. We understand that cost is a significant factor when choosing an insurance provider. That’s why we work hard to offer competitive rates on our tractor insurance policies. By comparing options from multiple insurers, we ensure that you receive the best possible coverage at a price that fits your budget.

Benefits of Comprehensive Tractor Insurance

Having a comprehensive tractor insurance policy offers numerous benefits, including:

- Financial protection. Safeguard your investment against the costs of repairs, replacements, or legal liabilities.

- Peace of mind. Know that your operations can continue without significant interruptions, even in the event of an accident or loss.

- Liability coverage. Protect yourself against potential legal claims resulting from accidents involving your tractor.

- Flexibility. Choose from a range of coverage options that can be tailored to meet your specific needs.

Get Started with Duliban Insurance Brokers

At Duliban Insurance Brokers, we’re committed to providing Ontario farmers and business owners with tractor insurance solutions that are as unique as their operations. We are committed to fostering lasting relationships with our clients, grounded in trust, openness, and outstanding service. When you choose Duliban, you’re not just getting an insurance policy; you’re gaining a partner who is dedicated to helping you protect what matters most.

Don’t settle for a generic insurance plan. Contact our tractor insurance company today to learn more about our customized tractor insurance in Ontario and how we can help you secure the right coverage for your needs. Let us provide you with the peace of mind that comes from knowing your tractor is fully protected.

We work with 20+ top insurance companies

Our Reviews

What you say matters to us

Frequently asked questions

New tractors – if purchased within 5 years, you will receive replacement cost with no deduction for depreciation. Used tractors – if older than 5 years, you will receive the current market value of a similar used tractor at the time of the claim.

Your policy will automatically renew on a monthly basis by billing the premium to your credit card on file. The documents will be emailed and mailed to the address on file. We are available at any time to discuss questions or changes to your policy. Your subscription can/ will be cancelled based on credit card issues (expiration or credit limit) or when instructed by you.

$2,000,000 liability coverage is included for the use of the tractor along with the property damage and bodily injury caused by its personal use and operation. For a complete list of liability exclusions, please contact us at any time.

This program is not designed to cover farm tractors or equipment. We can provide you with a separate quote for your farming operations, which encompasses alternative coverage for equipment, machinery and vehicles.

**Applicable to Nova Scotia, New Brunswick, & PEI. Coverage under the Tractor Protect program is not designed for tractors that require registration/plates. If your tractor will be plated, we recommend contacting a broker in your area to arrange the appropriate automobile policy.

Yes, all policies bound online through Tractor Protect will come with policy documents listing the lienholder on the document which can be sent to the dealer.

Frequently asked questions

Are you a dealership interested in working with us? Our team answers your questions about policy details.

The standard policy deductible is $500 which is lower than many farm and home policies. This can be reduced to $250 with the purchase of the Elite Plus Endorsement.

Yes, all policies bound online through Tractor Protect will come with proof of insurance sent directly to the dealer, instantly.

A tractor insurance quote is an estimate provided by an insurance company that outlines the cost of insuring your tractor. This quote includes the premium you would need to pay, as well as the coverage details such as liability, physical damage, and any additional protections like coverage for attachments or implements. Obtaining a tractor insurance quote is essential because it helps you understand the potential costs and coverage options available, allowing you to choose a policy that best protects your investment in the tractor and your farming operations.

Tractor Protect is now available in Ontario, New Brunswick, Nova Scotia, Prince Edward Island.

Tractor Protect is not designed to cover machines used for business use. We do have alternate plans available and would be happy to assist you.

Please call us at +1 855-385-4226.

Get a quote today

Working with a broker guarantees your access to the best available insurance with the added benefit of personalized support. See for yourself and get a quote now.

Read our blogs

Hear what’s trending in insurance

Our blog is packed with the tips and tricks you want to read, and deserve to know.

Winter storms can bring heavy snow, ice, and strong winds, all of which can lead to power outages that last

If you work in construction, you know that every project relies on a mix of professionals, from general contractors overseeing

As winter loosens its grip and the days grow longer, farmers know that spring signals more than just warmer weather—it

Being your own boss comes with plenty of perks—flexibility, independence, and the ability to build something truly your own. But

When it comes to employee benefits, one size does not fit all. While traditional group benefits plans offer structured coverage,

Life insurance is one of the most important financial decisions you’ll make for your family. It provides security, ensuring your