Home » Home Insurance

Ontario Home Insurance

Protect the place you call home.

We specialize in affordable coverage, no matter your living situation. Unlock a better rate and maximum savings on your home, rental, cottage and more.

We’re in the business of protecting your favourite places & spaces.

Explore affordable home insurance options in Ontario, crafted to suit your unique needs by our experienced insurance brokers. We are committed to providing cost-effective coverage that safeguards your home and belongings without compromising quality or peace of mind.

Bundles & Discounts

Some things are just better together

Save up to 50% on home, plus 20% on auto with a variety of our multi-policy discounts. Conveniently manage both of your policies under one roof with 24/7 access through our self-serve portal.

Custom coverage, no matter where you live.

Types of Home Insurance in Ontario

We offer comprehensive plans that are dedicated to protecting your favourite spaces and places.

House Insurance

Whether you own or rent, a tailored house insurance policy protects your dwelling and belongings, safeguarding you against unexpected events.

Condo Insurance

Condo insurance is tailored for condo owners in Ontario, providing protection for your unit, personal property, and liability. Fully tailored to you, this is meant to complement the condo corporation’s master policy.

Tenant Insurance

For renters in Ontario, tenant insurance is essential. It protects your personal belongings, offers liability coverage, and can even cover additional living expenses if your home becomes uninhabitable.

House Insurance

Whether you own or rent, a tailored house insurance policy protects your dwelling and belongings, safeguarding you against unexpected events.

Condo Insurance

Condo insurance is tailored for condo owners in Ontario, providing protection for your unit, personal property, and liability. Fully tailored to you, this is meant to complement the condo corporation’s master policy.

Tenant Insurance

For renters in Ontario, tenant insurance is essential. It protects your personal belongings, offers liability coverage, and can even cover additional living expenses if your home becomes uninhabitable.

Airbnb Insurance

If you own rental properties in Ontario, rental property insurance is paramount in protecting your investment. This covers your units, preserving your income stream amidst unexpected events.

Airbnb Insurance

If you own rental properties in Ontario, rental property insurance is paramount in protecting your investment. This covers your units, preserving your income stream amidst unexpected events.

Cottage Insurance

Enjoy the serenity of Ontario’s lakes and forests with cottage insurance. This one-of-a kind program shields your getaway retreat from seasonal risks and provides year-round peace of mind.

Cottage Insurance

Enjoy the serenity of Ontario’s lakes and forests with cottage insurance. This one-of-a kind program shields your getaway retreat from seasonal risks and provides year-round peace of mind.

Home Insurance in Ontario

Home insurance in Ontario is an essential safeguard for homeowners, providing protection against various potential risks and financial losses. Understanding the different aspects of home insurance can help you make informed decisions about your coverage.

Home insurance typically includes several types of coverage. Dwelling coverage protects the physical structure of your home, including walls, roof, and any attached structures like a garage. Personal property coverage extends to your personal belongings, such as furniture, electronics, clothing, and appliances, covering them against risks like theft, fire, and vandalism. Liability coverage is crucial as it protects you against legal claims if someone is injured on your property or if you accidentally cause damage to someone else’s property.

Additionally, additional living expenses (ALE) coverage can be a lifesaver, covering the cost of temporary housing and other expenses if your home becomes uninhabitable due to a covered event. Coverage also often includes detached structures, providing protection for structures not attached to your home, like sheds, fences, and detached garages.

In addition to standard coverage, there are optional coverages. Flood insurance covers damage caused by flooding, which is not typically included in standard home insurance policies. Earthquake insurance provides coverage for damage due to earthquakes, often excluded from standard policies. Sewer backup insurance protects against damage from sewer backups, which can be a costly problem. Identity theft coverage helps cover the costs associated with restoring your identity if it is stolen.

Quote on House Insurance in Ontario

Home insurance is calculated on an individual basis. Insurers assess the level of risk associated with you and your property to determine a personalized quote. Here’s a brief overview of the factors that will influence your next home insurance quote:

- Home replacement value. This is the amount of money needed to rebuild your home if it is destroyed. The higher the replacement cost, the more coverage you will need, resulting in a higher premium. You can also choose guaranteed replacement coverage, which ensures your home is covered for a full rebuild even if the cost exceeds the policy limit.

- Property type and use. Home insurance brokers in Ontario consider how many people live in your household and whether you rent out your property for additional income. The more risk you present, the higher your premium will be.

- Property age. Older homes are more prone to damage, so newly built properties often have cheaper insurance premiums.

- Property size. Larger homes require more coverage. Therefore, insuring a 7,000-square-foot mansion will cost more than insuring a 500-square-foot apartment.

- Location. Your home’s location significantly impacts your insurance rate. Homes near bodies of water or in high-crime areas are more likely to have higher premiums. Conversely, living near a fire station or fire hydrant can reduce your premium.

- Roofing. A newer, higher-quality roof can lower your home insurance premiums because it reduces the risk of damage claims due to severe weather.

- Exterior materials. Newer homes, brick homes, and homes made of fire-resistant materials tend to have lower premiums. As buildings age, they are more likely to experience issues like leaky pipes, leading to higher house insurance quotes in Ontario.

- Heating, plumbing, and electrical systems. Older systems can result in premiums, and some insurers may require upgrades before providing coverage. This applies to items like wood-burning stoves, galvanized steel plumbing, knob and tube wiring, fuel oil tanks, and 60-amp electrical systems.

- Accessory structures. Additional structures, such as garden suites or pools, also need coverage, which can increase your home insurance rate.

The extent and type of coverage you choose will affect your premium. Higher coverage limits and additional coverages, such as for high-value items or specialized risks, will increase the cost of your insurance.

By understanding these factors, you can better anticipate your home insurance quote in Ontario and make informed decisions when selecting coverage.

On the Duliban Insurance Brokers’ website, you can check out online quotes on house insurance in Ontario.

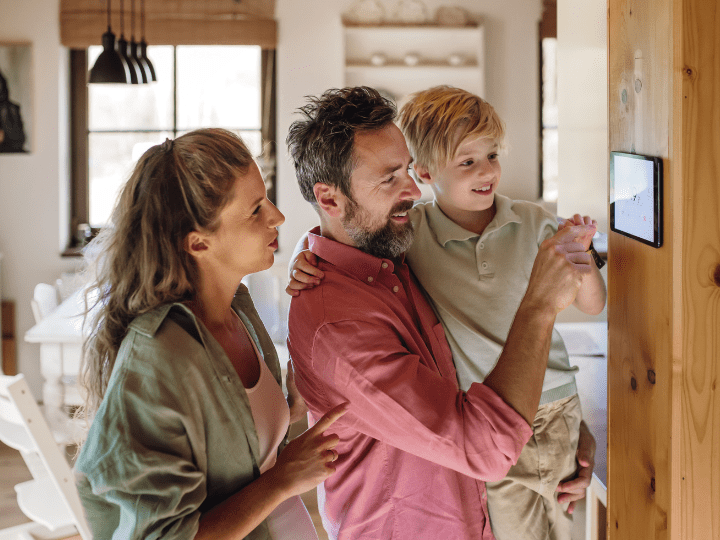

Benefits of Home Insurance with a Reliable Home Insurance Broker

The benefits of securing home insurance through a reputable home insurance broker are numerous. Here are a few key advantages:

- A trusted house insurance broker offers expert advice tailored to your specific needs. The experts at Duliban Insurance Brokers will assess your unique situation and make recommendations on the best insurance coverage options to effectively protect your home and property.

- Home insurance brokers work with a variety of insurance companies, giving you access to a wide range of coverage options and competitive rates. Duliban Insurance Brokers compares policies from different providers to find the best option that fits your needs and budget.

- Unlike buying insurance directly from a company, working with a broker provides a personalized approach.

- In the event of a claim, a trusted home insurance broker acts as your advocate. Duliban Insurance Brokers will guide you through the claims process, help you navigate the paperwork, communicate with the insurance company, and maximize your benefits.

- Your relationship with your home insurance broker does not end once you purchase your policy. Duliban Insurance Brokers provides ongoing support, answers questions, periodically reviews coverage, and adjusts your policy as needed to reflect changes in your circumstances.

By working with a reputable Duliban Insurance Brokers’ home insurance broker, you can rest assured that your home and possessions are well protected. Are you interested in online home insurance quotes in Ontario? Contact us now at +1 855-385-4226.

We work with 20+ top insurance companies

Our Reviews

What you say matters to us

Frequently asked questions

You asked, we answered. Hear what our brokers have to say about some of the top insurance questions in Ontario.

This covers a variety of expenses, including property damage, loss of personal property and theft. Your policy will also include private liability, and any added living expenses are often included in the case of an emergency or displacement. A basic homeowner’s insurance policy does not cover flood, earthquake, or voluntary acts of negligence.

The actual cash value of a personal item or piece of property is the cost of the item sold AS-IS on the current market. If you have owned a private property or structure, their value would have depreciated over that time. Actual cash value will factor this into the final cost. However, replacement cost value is the amount of money it will take to replace your property or damaged goods without deducting for depreciation.

If you are serious about protecting your assets and investments, it is recommended that you carefully document your property and the personal items inside. It’s good practice to walk through your home and take detailed pictures of all your big-ticket items, such as jewelry, appliances, electronics and antiques/ collectibles. If something unfortunate were to happen, this would serve as proof of ownership and show the condition of the item(s) prior to any damage.

Safeguarding your home is the number one investment you can make which will impact your premium. Deadbolts on all of your entry doors and locks on your windows is a great place to start. Installing security and fire alarm systems that automatically notify the local police and fire departments will help to keep your property safe, even when you’re not home.

Installing and maintaining smoke detectors should be another priority for any homeowner, and if you have the means, a sprinkler system and carbon monoxide detector could help to save you from a great deal of damage should a fire break out in your house.

Remove any potential hazards to the best of your ability, such as keeping your walkways and entry points clear – specifically during the winter season. Salting your sidewalk and shoveling snow could save you a lot of time and hassle if something were to happen to a neighbor or passerby. In addition, restricting all access to “attractive nuances” such as swimming pools and trampolines is a good idea.

With homeowner’s insurance, you may be afforded coverage for the neighbour’s injury. Your policy will cover medical costs resulting from the wound on your property, as well as any legal fees and costs to repair damages that led to our occurred during the injury. (This coverage assumes you were not voluntarily negligent.)

Accident discharge of water due to an issue with your plumbing system is included in your homeowner’s insurance plan. If something should happen to your plumbing system causing it to leak into your home, your policy will cover the costs associated with restoring the property. Check your plumbing system at least once per year to ensure everything is operating as it should be.

If you happen to live in an area prone to flooding or earthquakes, it is recommended that you add a rider or endorsement to your policy to include damages and loss as a result of these events. Our team can assist you in securing this coverage.

Homeowner’s insurance is not lumped into your mortgage payments unless you request that your insurer opens an escrow account, allowing you to combine your payments together. This has become a more common practice amongst first-time home buyers for more convenient billing.

There are many reasons why you should, or could, add to your current homeowner’s insurance policy. For example, if you are adding on to your existing property, you should contact your insurance provider to include this extension and receive guidance on what your plan should now include. You should also consider adding more coverage if you purchase land separate from your current plot, if you are buying another home, or going to rent a structure to others.

You may want to update your homeowner’s insurance policy if you make a significant purchase, such as expensive jewelry, a computer, or even new appliances for your kitchen. If you add to your investments in any way, you should immediately document the changes and contact your insurance professional to consult them on the necessary changes needed to keep your insurance program up to date.

You can find out home insurance quotes and order the service at Duliban Insurance Brokers by calling +1 855-385-4226.

Get a quote today

Working with a broker guarantees your access to the best available insurance with the added benefit of personalized support. See for yourself and get a quote now.

Read our blogs

Hear what’s trending in insurance

Our blog is packed with the tips and tricks you want to read, and deserve to know.

January often arrives with a mix of ambition and realism for small business owners. The rush of the previous year

January has a way of slowing things down just enough for people to start asking questions they have been putting

Technology is changing nearly every aspect of daily life, and insurance is no exception. While innovation often brings convenience and

Many people stay with the same insurance provider year after year without giving it much thought. Insurance can feel like

Article Overview: As vehicle theft continues to rise across Canada, many drivers are seeing unexpected increases in their auto insurance

Ridesharing continues to grow in popularity, with more drivers turning to platforms like Uber for flexible income. In 2026, this