A standalone coverage solution for your tractor

When adding onto your home policy just won’t cut it, we’ve got an enhanced program dedicated to the niche coverage you’re looking for. Buy your policy online in minutes, with Tractor Protect.

A one-of-a-kind program built specifically for you.

Welcome to Duliban Insurance, where we understand that a one-size-fits-all solution won’t cut it when it comes to tractor insurance. Our commitment to offering personalized auto insurance reflects our belief that every driver is unique, deserving of a policy designed to meet their individual needs and preferences.

why protect

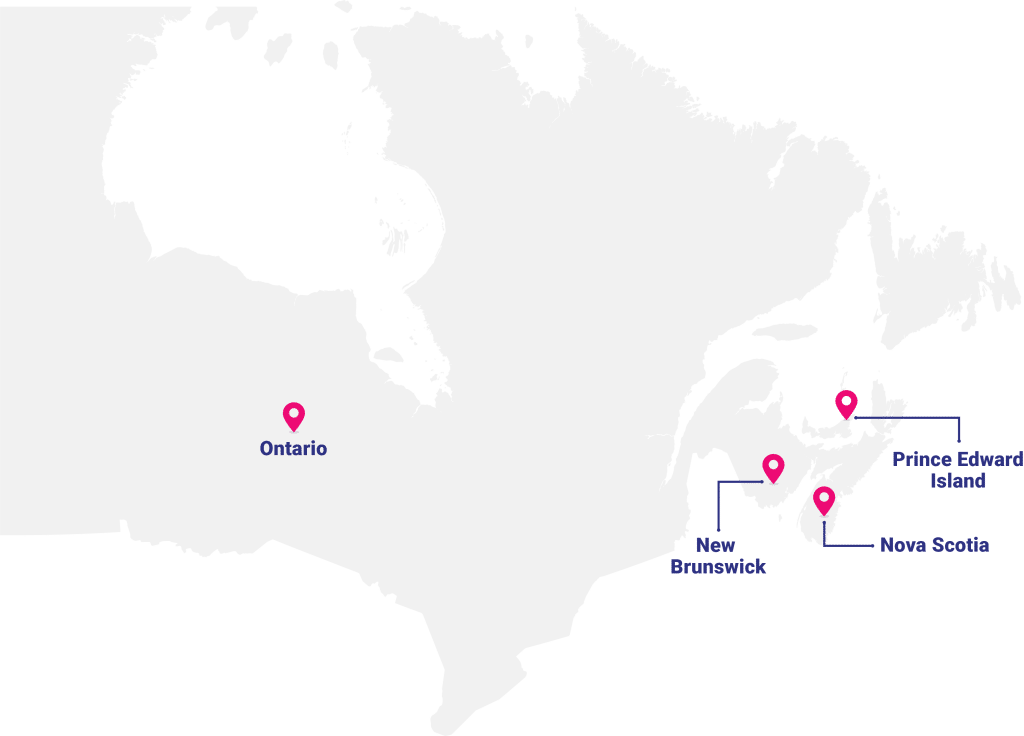

Where can you get coverage?

We provide coverage in Ontario, New Brunswick, Nova Scotia, and Prince Edward Island.

qualifications

Does your tractor qualify?

In order to be eligible for this program, your tractor must not be used to generate a profit or for farming operations.

why protect

Why protect your tractor with its own policy?

Rather than add your tractor to an existing home policy, Tractor Protect provides extended coverage beyond your premises. For example, if you were to assist a nearby neighbour or clear the snow at the end of your driveway, a tractor on your home policy would cease to protect you from liability in the event of an accident.

We found this to be a major gap in the existing industry, and sought to provide extendable coverage that protects off-property activities without requiring an independent farm policy.

Tractor Protect includes additional features with the Platinum Endorsement Package. With this fee increase, you would benefit from:

- Decreased deductible to $250 from $500

- $25,000 extension of coverage for tractor accessories

- $2,500 coverage for a rental tractor

Want to know how much your tractor will cost?

We work with 20+ top insurance companies

Our Reviews

What you say matters to us

Frequently asked questions

Considering this program for your tractor? See what others are asking before binding coverage?

New tractors – if purchased within 5 years, you will receive replacement cost with no deduction for depreciation. Used tractors – if older than 5 years, you will receive the current market value of a similar used tractor at the time of the claim.

Your policy will automatically renew on a monthly basis by billing the premium to your credit card on file. The documents will be emailed and mailed to the address on file. We are available at any time to discuss questions or changes to your policy. Your subscription can/ will be cancelled based on credit card issues (expiration or credit limit) or when instructed by you.

$2,000,000 liability coverage is included for the use of the tractor along with the property damage and bodily injury caused by its personal use and operation. For a complete list of liability exclusions, please contact us at any time.

This program is not designed to cover farm tractors or equipment. We can provide you with a separate quote for your farming operations, which encompasses alternative coverage for equipment, machinery and vehicles.

**Applicable to Nova Scotia, New Brunswick, & PEI. Coverage under the Tractor Protect program is not designed for tractors that require registration/plates. If your tractor will be plated, we recommend contacting a broker in your area to arrange the appropriate automobile policy.

Yes, all policies bound online through Tractor Protect will come with policy documents listing the lienholder on the document which can be sent to the dealer.

Frequently asked questions

Are you a dealership interested in working with us? Our team answers your questions about policy details.

The standard policy deductible is $500 which is lower than many farm and home policies. This can be reduced to $250 with the purchase of the Elite Plus Endorsement.

Yes, all policies bound online through Tractor Protect will come with proof of insurance sent directly to the dealer, instantly.

Tractor Protect is now available in Ontario, New Brunswick, Nova Scotia, Prince Edward Island.

Tractor Protect is not designed to cover machines used for business use. We do have alternate plans available and would be happy to assist you.

Get a quote today

Working with a broker guarantees your access to the best available insurance with the added benefit of personalized support. See for yourself and get a quote now.

Read our blogs

Hear what’s trending in insurance

Our blog is packed with the tips and tricks you want to read, and deserve to know.

As you embark on this exciting journey of buying your first home, there’s a lot to consider—from crunching the numbers

Welcome to the Smart Home Era With the rapid adoption of Internet of Things (IoT) devices, our homes are smarter

Calling all pet parents! Are you planning your next adventure with your furry friend by your side? As much as

As more and more people seek authentic connections to their food and the land, sustainable agri-tourism is emerging as a

Are you ready to share the joy of Airstream living with travelers from around the world? Whether you’re looking to

In an era where small businesses are the backbone of the Canadian economy, representing 97.9% of all companies in the