Car insurance prices are increasing across the industry, 20 insurance companies had their rates approved for an average 2.06% increase. If your insurance is with a broker than you may not have to suffer, brokers have an advantage over a direct insurance company as they can shop your insurance and provide you multiple options. As your Hometown Insurance Broker our main purpose is to work with you to arrange tailored insurance coverage at the most competitive premium possible, to help you 24/7 in the event of a claim and to provide best in class ‘Hometown’ Customer Service!

Your Top 3 Insurance Questions Relating to Price

We have tracked the 3 most frequently asked Auto Insurance Questions and wanted to share them with you!

- My vehicle is getting older why is my rate increasing?

- Why am I paying for other people’s mistakes or accidents?

- What makes car insurance in Ontario so expensive?

The reality is; the insurance company paying to replace your vehicle is the least of their concern! A small percentage of the premiums you pay is assigned to potentially repairing or replacing your vehicle in the event of a claim. With a standard car insurance policy in Ontario, there is up to $1,000,000 of coverage if you are catastrophically injured and more commonly $2,000,000 of liability coverage to protect you in the event of an injury resulting from an accident you may have caused.

Over the past years, we have seen a significant increase in the frequency and severity of lawsuits and injury claims. A settlement of $1,000,000 or more is very common. It is for this reason why we recommend $2,000,000 liability coverage or higher in addition to increased accident benefit coverage for you. Consider the fact that your insurance premium pays for this rising exposure, how many times you would have to pay your premium to make up such a claim of this size!

As your dedicated broker, we are fortunate to have working relationships with over 20 of the top Insurance Companies in Canada. In the past, 4 to 5 factors made up your premium, now there are more than 200 factors! It is never been more important to speak to us and ensure all of your information is up to date, this is critical to ensuring the most competitive premiums possible!

Insurance Discounts You May Qualify For

Please call, email, text or send us a message if you now qualify for any of the following or would like to learn more about your current policy and if any of these will apply!

- Two or more auto/ Multi-Vehicle Discount

- Multi-Policy Discount or Combined myHome&Auto

- Annual km’s-are you driving less then in the past?

- Commuting Distance-are you driving less one way to work?

- Retiree Discount

- Underage Occasional Driver Away @ University (>100kms)*

- Winter Tire

- Good Student Discount (A or > 80%)*

- Hybrid vehicle

- Telematics Discount (myDriving)

- Retiree (65+- no employment for 26 weeks or > in last 52 weeks)

- Conviction Free*

- Autonomous Breaking*

- Tracking System

- Etching System

It is very important to us to work with you to maximize the discounts you are receiving and to ensure you have the best coverage for your individual need!

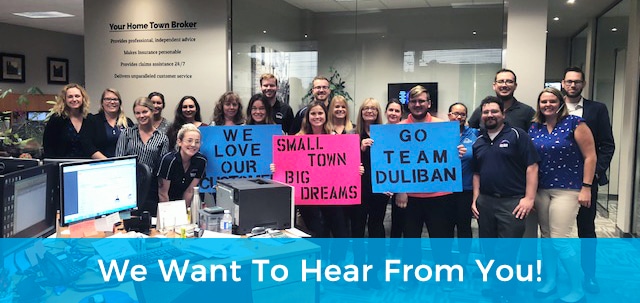

Adam Duliban,

third generation Co-owner of our family business.